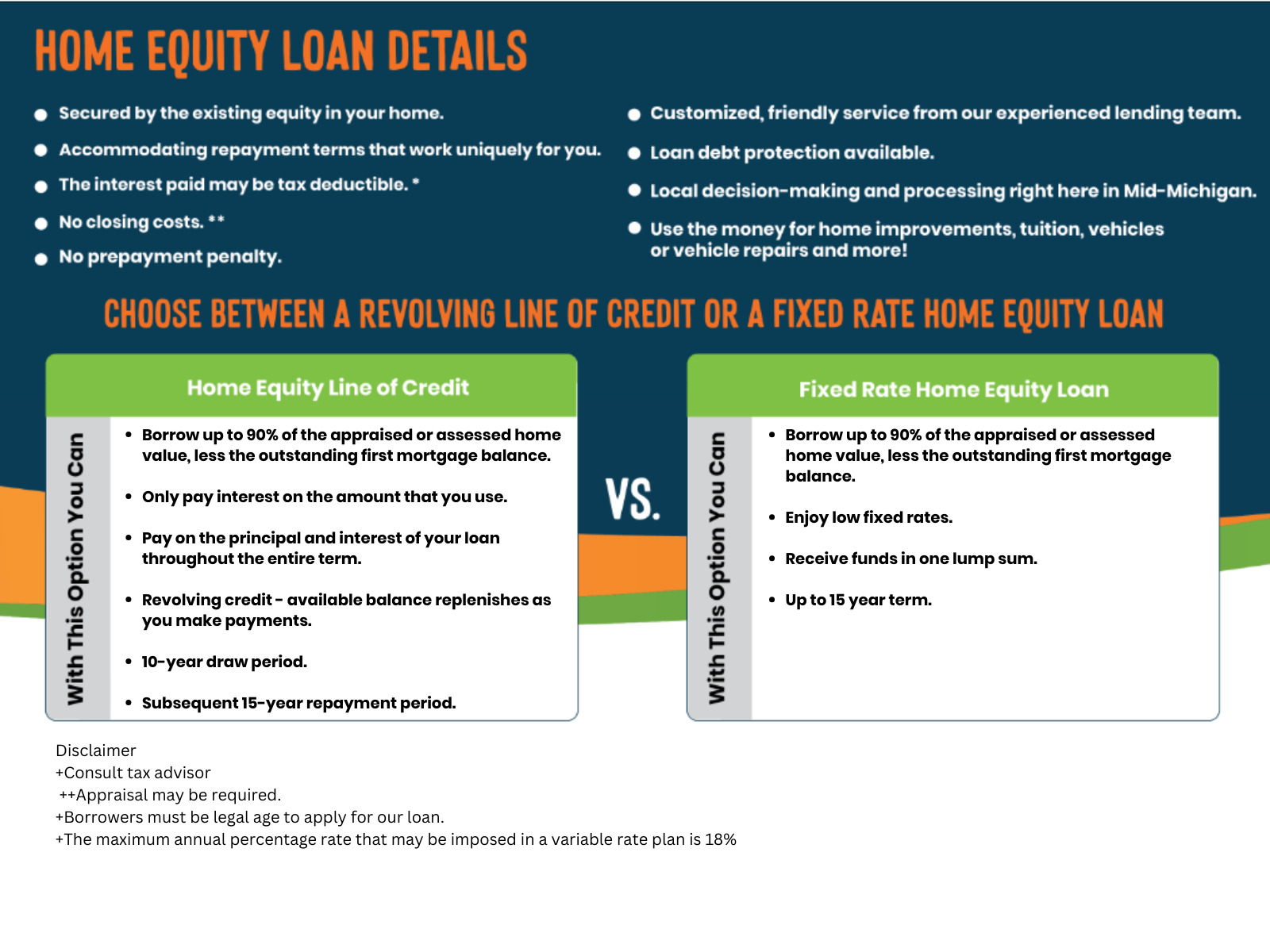

Your home’s been holding out on you. Convert that hard-earned equity into cash you can use for anything. We offer both lump-sum loans and lines of credit.

Key Features

-

![]() Competitive Rates

Competitive Rates

-

![]() Fast Decisions

Fast Decisions

-

![]() Local Service and Processing

Local Service and Processing

- The existing equity in your home is used as collateral backing

- Borrow up to 90% of the appraised or assessed home’s value less than the outstanding first mortgage value

- Enjoy low rates

- Loan debt protection available

- No closing costs**

- Local decision-making and processing right here in Mid-Michigan

- Customized, friendly service from our experienced lending team

- Accommodating repayment terms that work uniquely for you

- The interest paid may be tax deductible*

*The maximum annual percentage rate that may be imposed in a variable-rate plan is 18%*

*Consult a tax advisor.

**If Appraisal is needed, there will be an Appraisal fee of $500.

Borrowers must be of legal age to apply for a loan.

*Consult a tax advisor.

**Appraisal may be required.

Borrowers must be of legal age to apply for a loan.

*The maximum annual percentage rate that may be imposed in a variable-rate plan is 18%.