Relaxing in a space that is truly yours is priceless. A mortgage loan from TRUE Community makes it all possible.

Key Features

-

![]() Competitive Rates

Competitive Rates

-

![]() Free Pre-Approval

Free Pre-Approval

-

![]() Refinancing Available

Refinancing Available

TRUE Community is pleased to provide some of Mid-Michigan's lowest closing fees as well as competitive rates.

Already own a home? Existing homeowners can benefit by refinancing their existing loan with us.

You could potentially reduce your monthly payment significantly.

Loans available for primary residence, second homes, vacation homes, or investment properties

With a TRUE Community Credit Union Mortgage Loan, you will be able to expect:

- A wide range of financing programs available:

- Fixed-rate mortgages

- Non-conforming loans

- And more

- Some of Mid-Michigan's lowest closing costs

- Prompt closing; typically within four weeks

- Online access to your existing mortgage

- Free pre-approval for extra confidence when it comes to securing financing

- Refinance your current home to potentially lower your rate

- Helpful loan advisors with working knowledge of the local real estate market

- Customized, friendly service from our experienced lending team

- Local decision-making and processing right here in Mid-Michigan

- In-house servicing — your mortgage stays at TRUE Community Credit Union

Check Your Information

To view your up-to-date Mortgage info, use eStatus Connect!

See Our Rates

Looking for the numbers? We're proud of our low rates — check them out.

Conventional First Time Home Buyers Program

- 3% down payment

- Lower PMI and closing costs

- Great for low to moderate incomes

- Credit scores as low as 620

FHA

- Low down payment

- Expanded credit guidelines

- Ideal for first time home buyers

VA - Veteran Administration

- No down payment

- Lower fees

- Must be a Veteran or active military

USDA - Rural Development

- No down payment

- Must purchase in qualifying rural areas

- Reduced mortgage insurance premiums

- Scores as low as 640

To register, make a payment or view up-to-date mortgage info, log in to eStatus Connect.

eStatus Connect Log In

When you log in to eStatus Connect, you can view:

- Mortgage history

- Current balance

- Escrow account

- Payment information

- 1098 Mortage Interest Statement Form Information

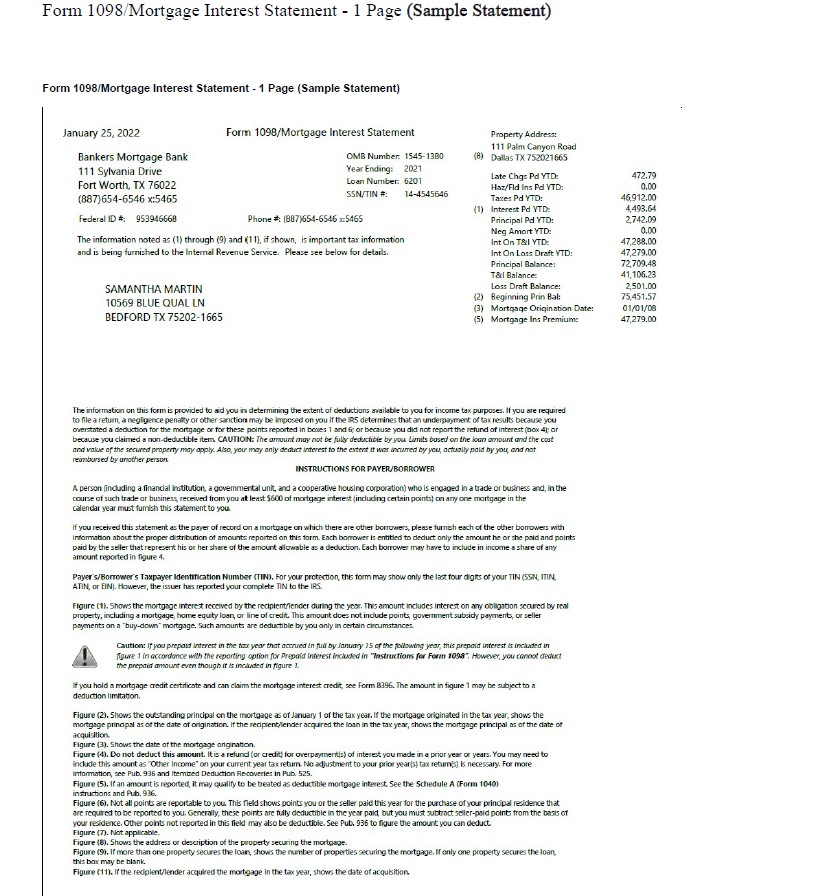

1098 Mortage Interest Statement Form Information

We wanted to let you know that you will be receiving our 1098 Mortgage Interest Statement forms in the mail soon.

You will notice that the forms look different than they have in the past. Please review Form 1098/Mortgage Interest Statement Sample below.

You will receive them in the mail in an envelope that indicates “Official Tax Document Enclosed.” We will also have the form available via eStatus Connect.

Please Note:

- The forms will look different (see Statement Sample).

- The forms will contain all of the necessary information for tax purposes.

- You will only receive a 1098 Mortgage Interest Statement if you paid $600.00 or more interest last year.

- A copy of the form will be in eStatus Connect.

- The forms will still come in an envelope that indicates “Official Tax Document Enclosed.”

Learn about purchasing a home, working with a lender,

using budget calculators and other home-buying topics.

Learn more about Home Buying Topics

Check Rates

We are Proud members of the Jackson Area Association Of Realtors and the Ann Arbor Area Board Of Realtors.

Conventional loans must meet Fannie Mae Guidelines; maximum loan amount for conventional loans is $548,250.00, Jumbo loans $750,000. All property financed with TRUE Community must be owner-occupied, no investment or rental property allowed. Conventional loans over 80% LTV must have Mortgage Insurance and are required to escrow for Mortgage Insurance, Homeowners Insurance and Property Taxes. Rates and APRs may vary depending on loan details, such as loan amount, loan-to-value, your credit, property type, purpose (purchase or refinance with cash-out vs. no cash-out), occupancy (owner occupied or second home) and points paid. Rates are subject to change without notice. You will need to speak to one of our loan officers to obtain a specific quote or to lock a rate.

Borrowers must be of legal age to apply for a loan.