It’s rewarding to be a Michigander — so we made a checking account that reflects that.

Key Features

-

![]() No Monthly Service Fee

No Monthly Service Fee

-

![]() No Minimum Balance Requirement

No Minimum Balance Requirement

-

![]() Earn Rewards

Earn Rewards

-

![]() Free Digital Banking

Free Digital Banking

- Get rewarded for your account activity and relationship with us*

- Earn competitive dividends and ATM fee refunds

- No monthly service fee

- No minimum balance requirement

- Free Mastercard® debit card

- Free Digital Banking, including:

- Free mobile pay services available

- Surcharge-free ATMs available

- Overdraft privilege available

- No minimum deposit to open in person

- $200 minimum deposit to open online

How Does it Work?

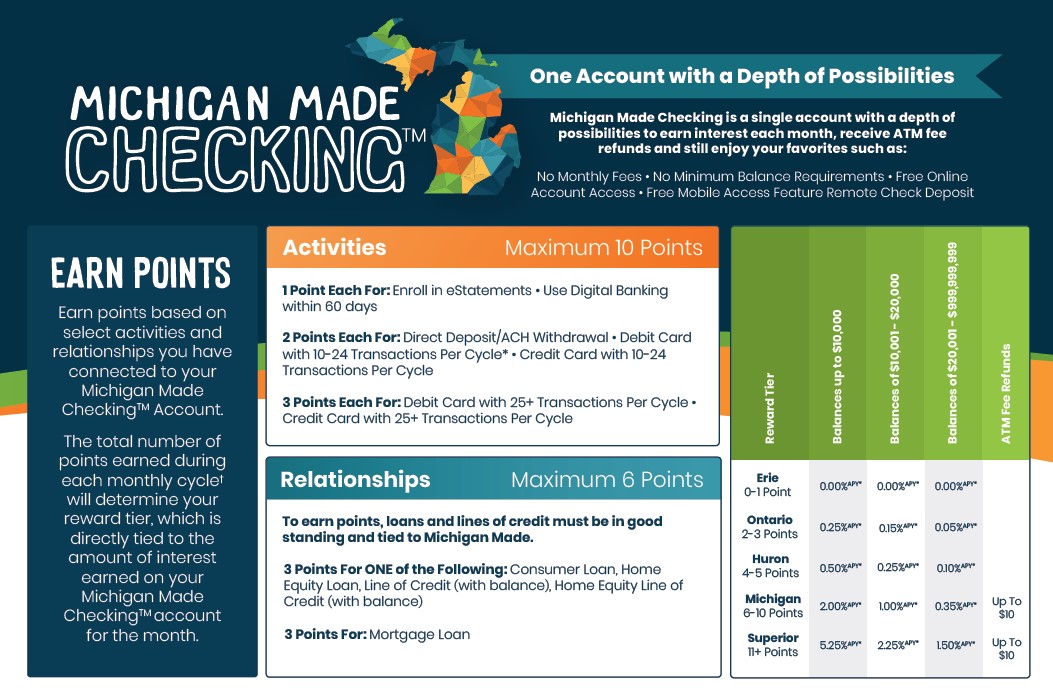

You’ll be awarded points based on certain account activities and your relationship with us. Points are awarded each monthly cycle and determine your reward tier. Your reward tier dictates how much you’ll enjoy in dividends and ATM fee refunds. You can earn up to 5.25% APY and $10 in ATM fee refunds!*

Activities – Maximum 10 Points

1 point each for:

- eStatements

- Use mobile banking or online banking within 60 days

2 points each for:

- Direct deposit/auto bill pay

- Debit card with 10-24 transactions per cycle

- Credit card with 10-24 transactions per cycle

3 points each for:

- Debit card with 25+ transactions per cycle

- Credit card with 25+ transactions per cycle

Relationships – Maximum 6 Points

To earn points, loans and lines of credit must be in good standing and tied to Michigan Made Checking™.

3 points for ONE of the following:

- Consumer Loans (auto loan, recreational loan, personal loan)

- Home Equity Loan

- Line of Credit (with balance)

- Home Equity Line of Credit (with balance)

3 points for:

- Mortgage Loan

Examples

If you were to have these products:

- eStatements +

- Used online banking +

- Used your debit card 10 or more times +

- Had a direct deposit coming into your account, or an automatic payment coming out of your account

You would be in the Michigan Tier, earning up to 2.00% APY AND up to $10 ATM fee refunds per month!*

If you were to have these products:

- eStatements +

- Used online banking or mobile banking +

- Used your credit card 10 or more times +

- Had a direct deposit coming into your account, or an automatic payment coming out of your account

- Used your debit card 25 or more times +

- Had an auto loan with us

You would be in the Superior Tier, earning you up to 5.25% APY AND up to $10 ATM fee refunds per month!*

For a full list of the tiers, check out the section below!

The Michigan Made Checking™ account features five reward tiers, named for our Great Lakes. Each reward tier offers varying interest rates with the opportunity to earn up to 5.25% APY and ATM fee refunds on select tiers.*

| Reward Tier |

Balances up to $10,000 |

Balances up to $10,001-$20,000 | Balances up to $20,001-$999,999,999 | ATM FREE Refunds |

|

Erie 0-1 Point |

0.00% APY* | 0.00% APY* | 0.00% APY* | |

|

Ontario 2-3 Points |

0.25% APY* | 0.25% APY* | 0.05% APY* | |

|

Huron 4-5 Points |

0.50% APY* | 0.25% APY* | 0.10% APY* | |

|

Michigan 6-10 Points |

2.00% APY* | 1.00% APY* | 0.35% APY* | Up To $10 |

|

Superior 11+ Points |

5.25% APY* | 2.25% APY* | 1.50% APY* | Up To $10 |