Your Money is safe with us! For added protection, we provide our members with Excess Share Insurance (ESI).

More Protection, More Security and More assurance

We are pleased to inform your deposit accounts in TRUE Community Credit Union are insured for up to $500,000. This exceptional level of coverage is attained through a combination of federal insurance provided by the National Credit Union Administration (NCUA) and private insurance from Excess Share Insurance Corporation (ESI).

Your TRUE Community Credit Union deposit accounts are insured up to $500,000.

This coverage will be automatically applied to accounts exceeding the NCUA limits ($250,000) up to a total of $500,000.

Amounts over $500,000+ will not be covered.

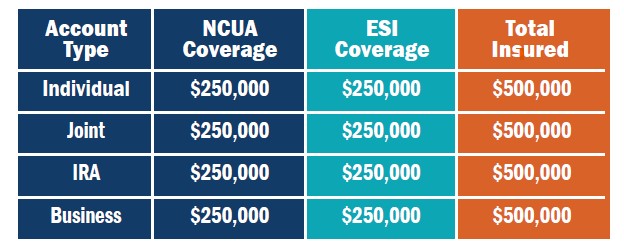

All individual savings, checking and certificates of deposit accounts held by the same member are added together and insured up to $250,000 by NCUA and an additional $250,000 by ESI, for a total of $500,000.

All IRA accounts held by the same member are added together and insured up to $250,000 by NCUA and an additional $250,000 by ESI, for a total of $500,000.

All joint accounts held by the same member are added together and insured up to $250,000 by NCUA and an additional $250,000 by ESI, for a total of $500,000.

Investment Service accounts are not eligible for coverage.

Coverage Per Member with Excess Insurance*

*Example only